A personal finance blog about trading, investing, and other wealth building strategies. Learn how to trade options, get trade ideas, and make money online from home.

Sunday, February 28, 2010

Could this be the catalyst for a test of January Highs?

All I am saying is this could be the piece of news that may change attitudes, as prospects of the tax payers money being paid back. I think it bodes well for the market overall. But we will just have to wait and see.

This could be interesting for the market!

Saturday, February 27, 2010

February Results - DD

Thursday, February 25, 2010

GME, another name from the watchlist coming down to my level

When this stock first came on my radar the stock was trading at $20.42 and has since sold off after several downgrades and an earnings miss. Call me a bottom feeder if you will, but I like the name and am willing to make the bet. I had written down that I was interested in the stock around $17 a share which is close to its 3 year low at 16.91. See chart below:

This is an investment idea. I am looking to buy the ITM 15 calls out in Jan '12. They are currently trading at about $5 an call.

Target: $28-30

Break even by expiry: $20

Stop: Below $15

Risk/Reward: 1:7 ish

Here are the price slices from the option pricing model:

Buy 5 Jan '12 15 calls @ limit $5

Wednesday, February 24, 2010

RIG, betting on the black gold...

Tuesday, February 23, 2010

AZN is looking good!

As you can see highlighted in the chart the stock has been basing in a very tight $0.50 range from 43.50-44 since its Q4 miss in late January. Look at the candlestick where the low was put in at 42.21, this shape of candle stick is known as a hammer which more often than not signals a reversal in direction. So I like the fact that AZN traded faily quickly off this low and has been basing.

So the trade: I am looking to buy 5 of the Jan '11 $45 calls @ 3.30. Now why am I buying so far out? I like the January calls as I am betting that this stock will play catch up with its earnings estimates but it may need a few quarters to prove to investors that it can do it. AZN reports in April, July, and October. So this will allow me to capture 3 quarters, which should be plenty of time for this stock to work. Last report in October is after option expiration which leaves Jan '11, thus the best choice for me.

Lets take a look at the Scenario analysis from TOS:

Stock price: Currently at $43.5

Target: 55-60

Stop : Below 40 (pretty big support level from 2009)

Risk/Reward : 1:2 or better depending on speed of move and ultimate price

Holding period: 2-9 months

The market seems weak as I write this post. SPX is down about 12 points.

Buy 5 Jan '11 45 calls @ limit of $3.30 or better.

Monday, February 22, 2010

Actual position in STEC

As I mentioned in the analysis last week. STEC will be reporting tomorrow. There is a lot of uncertainty that surrounds this name. Currently the options market is pricing in a 21% move in this name. I wanted to play this with a unbalanced straddle. And this is still true, my strikes have just changed since the stock has traded lower. See new risk profile and analysis from TOS platform below:

Spec trade in SII

The risk here is that there is regulatory hurdles that could kill the deal. But I am going to bet on the deal going through.

Sell 1 Jan '10 $45 put at limit price of $7 or better.

Sunday, February 21, 2010

Saturday, February 20, 2010

1099 for 2009

This is the bottom portion of my 1099 from 2009. It will take me a while to correctly construct an Excel sheet so I can break it down trade by trade. However, the bottom line results are pretty much in line with what I thought. For every dollar lost in my long portfolio (-$31,986) during the financial crisis, I made it back with options. The total for the year is (-$683), which means option profit was about $31,300. I knew I was close to break even because I remember liquidating most of the positions as my account balance neared its pre-crisis level. However, at the end of 2009 I still had about $30,000 of MTM unrealized gains. I'm the first to admit that a MTM gain means dogshit, realized gains are all that matters to me for record keeping or comparison purposes. So 2009 was a net loss and that $30,000 will be gains in 2010 unless I lose it before they expire.

New Investment in MO

On Thursday I bought 2000 shares of MO at $19.90. I sold (20) Jun 10' $20 calls for .54. There are two dividends before the June expiration of .34 each. Here are the three scenarios that can play out.

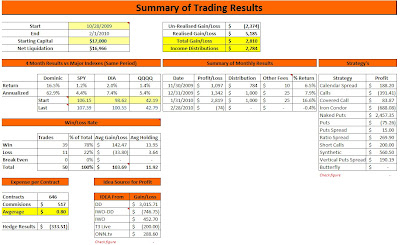

Feb Trading Results

Thursday, February 18, 2010

Stocking PFE

Currently I am not initiating a position yet. But I do have an alert set at $17.25 to bring my attention back to the stock. I think a test of the 200 day is likely, but I also think that this level will act as support. I will update with a possible position later if my entry price is hit.

Wednesday, February 17, 2010

Short the Futures

Tuesday, February 16, 2010

Investment idea in PDLI

As you can see this company receives royalties for the antibody's that it has created and patented. I have been doing a lot of reading up on this company because I was really confused when I saw that it paid a 15% dividend. But after digging a bit deeper it looks like this company's earnings power is good until it major patents expire in 2014, assuming they don't patent new antibodies. So this is not a company you buy and hold forever. But I think that it will perform well over a 2 year holding period. It already has two $0.50 dividends scheduled to be paid out in April and October. I am always skeptical when I look at BioPharma names as I got burned pretty good on one. But the difference now is I don't blindly go into a company. And I want to see that the company is making money and will continue to do so for the foreseeable future.

Here is a daily chart of PDLI:

Also plotted you will see the earnings history as well as the dividend history. It looks like the sell in December was due to the payment of the $1.67 special dividend that was paid out.

Here is the announcment of the dividends this year:

Distribution Dates of April 1 and October 1, 2010

INCLINE VILLAGE, Nev., Jan. 28 /PRNewswire-FirstCall/ -- PDL BioPharma, Inc.

(PDL) (Nasdaq: PDLI) today announced that it will pay two special dividends to

its stockholders in 2010. Each of the dividends will be $0.50 per share. The

first special dividend will be paid on April 1, 2010 to all stockholders who

own shares of PDL on March 15, 2010, the Record Date. The second special

dividend will be paid on October 1, 2010 to all stockholders who own shares

of PDL on September 15, 2010, the Record Date.

Again I plan to use the sell of puts to enter this trade as I did in ANH. I am going to sell 3 Feb '10 $7.50 puts. Right now they are trading at $0.80, which would get me a purchase price of $6.70 exactly where the stock is trading right now. I am going to try and squeeze an extra nickle out of the bid x ask spread. If not I will just sell it for the $0.80. Based on the probabilities I have about a 33.5% chance of them expiring worthless. Again I am okay with this as I would achieve a higher percentage return then just collecting the dividend. If you want to see the math see my post on ANH.

Sell 3 Feb '10 7.50 puts @ -0.85.

Dean Foods (Synthetic Long)

First lets look at the daily chart:

You can see on the day of the earnings the stock sold of about $2.5 points and then another $1 or so when the downgrade happened the next day. The low that was put in stands at $14.27.

You can see on the day of the earnings the stock sold of about $2.5 points and then another $1 or so when the downgrade happened the next day. The low that was put in stands at $14.27.

Now lets take a look at the hourly to get a better picture of the buyers and sellers intraday. In this view it looks like that $14.27 could have been the capitulation low. As strong volume of about 4.2 million shares came in to defend this stock from going any lower.

Whats the game plan? I want to buy 5 synthetics, but I want to set a tight stop at $14.

Entry: $14.50

Stop: $14

Target: $17.50

Risk: $230-$300

Reward: $1,500 ( RvR 1:5)

I will be looking to buy 5 Jan '11 $15 synthetics @ a credit of about -$0.50 for a total credit of about $500.

Another one on Risk MGMT from Traderfeed.com

Risk Management in Trading and Emotional Self-Control

In the recent post, I reflected on the fact that I find the psychological needs of high frequency traders to be different--and greater on average--than those of traders who make decisions on longer time frames. We've also seen how large increases in trading size and risk contribute to the emotional ups and downs of traders. The problem traders call "overtrading" is often the result of frustration and poor impulse control; less well appreciated are the ways in which overtrading--both in size and frequency--help to initiate and sustain emotional dysregulation.It is axiomatic among the hedge funds where I work that, when you're not trading well, you reduce the risk associated with your portfolio. Very often, portfolio managers will take a little time away from markets, regroup and focus on areas of distinct opportunity, and then take limited risk in a limited number of positions. As markets begin to reward their views, they then participate more fully and gradually return to more normal risk-taking.

This psychological risk management strategy prevents traders from losing all their profits during a slump, but it also preserves the trader's psyche. Dampening P/L swings enables the trader to simply focus on markets and regain a sense for how markets are trading. Even among daytraders, it's not unusual to see the most successful ones take breaks in the trading day during difficult periods and stop trading for part of a day if losses are accumulating to an unusual degree.

One advantage of working at a professional trading firm is that there is at least one individual designated as a risk manager who, like a pitching coach, will come out to the mound and consult with you when you're not doing well. Sometimes the risk manager/coach will even have to take you out of the game for a while. This preserves mental capital as well as trading capital: the idea is to trade your smallest and your least when you're trading at your worst.

The independent trader has no dedicated risk manager and so has to rely on hard and fast loss limits, position sizing, and "time out" rules to regulate the psychological risks of trading. Mentally rehearsing these rules as part of pre-market preparation and post-market journaling helps cement them as habit patterns.

A lesson I've learned over many years of coaching and work as a trading psychologist is that poor trading practices can inflict considerable psychological damage. You can't sustain emotional self control if you don't have firm controls over how you trade.

How To Lose Money The Right Way (Traderfeed.com)

How To Lose Money The Right Way

So much of trading success comes from learning how to lose the right way. If many of the traders I work with followed a few basic guidelines about losing well, it would aid their performance immeasurably:2) Never lose so much in the morning that you can't battle back and be green for the day;

3) Never lose so much in a day that you can't rally and finish the week green;

4) Never lose so much in a week that you can't have a profitable month;

5) Never lose so much in a month that you can't make money for the year.

Psychologically, it's healthy to experience defeat and then overcome it. It strengthens you to battle back and win. If you lose the wrong way--by taking so much risk that you can't come back for the day, week, month, or year--you rob yourself of the victory that could be yours by going from red to green.

Discussion on Stop-Loss from Traderfeed.com

Stop-Loss Points in Trading: Do We Need Stops When We Trade?

Henry Carstens has recently written about ways to manage risk other than through stop loss points. I've noticed with traders recently that stops not only tend to be price-based, but tend to be placed at price points that are relatively obvious. For example, someone who is short stocks will place a stop just above a recent high or vice versa. Stops just above or below recent price ranges are also common.The problem with such stops is that they are natural targets for algorithmic programs that exploit asymmetries in buying and selling orders and tendencies. The trader with obvious stops falls victim to false breakout moves, exiting trades just before they reverse and go the intended way.

An important gauge of the value of your stops is to track markets *after* you have been stopped out. Do you stop loss points save you money on balance? Do they protect you from risk, or do they shake you out of opportunity? Most traders have never closely looked at the true value of their stops; they just take for granted that stops are needed and place them intuitively (and obviously).

Over the years, I've found that placing price-based stops further away from my entry at points where my underlying trade idea is clearly wrong helps keep me from getting shaken out of good trades. Those price-based stops act as "catastrophic" stops for me. More effective, as a rule, for my own trading have been indicator-based stops and time-based stops.

An example of an indicator-based stop would be a sudden surge in NYSE TICK to new highs or lows against my position or a surge in buying or selling volume against my position. As soon as I see the surge, I exit and reassess. More often than not, such a surge indicates that the short-term tide has moved against me and that it is not helpful to fight that.

Time-based stops are based on my observation that my best trades are executed well and tend to go my way relatively quickly, with little heat taken. If I have to sit and sit and sit in the trade, the odds that it will go my way eventually are diminished: the dynamics that placed me in the trade simply are not operative. Similarly, if the market moves against me very shortly after my entry, I generally find it's best to try to scratch the trade and reassess.

It *is* important to have stop-loss points for trades. As I've noted previously, everyone does have a stop-loss point: it is either explicit, based on market action, or it is unstated and based on pain. The latter can wipe out days' worth of good trading.

But while it's important to have stops, it's not necessarily the case that all stops need to be price-based. You should stop a trade when you see that the underlying idea is wrong, not simply when you've lost a certain amount of money.

Monday, February 15, 2010

Stocks on my Radar

STEC is a name that I am pulling back out of past names that I have made money in before. Last time I played this I entered somewhere around $11-$12.50 and exited in the $15-$17 range. It continued its up movement to around $20 before pulling back. As you can see on the chart below I have level of support drawn on the chart around $14. STEC closed on Friday at $15.02. So we are about $5 off of the recent highs. I think $15 offers a good risk/reward entry with a stop below $14. I am looking for a retest of the high of $20.45 set on 1-13-2010.

Risk/Reward = 1:5

Entry = Around $15

Stop = Below $14

Bias = Bullish

Next Catalyst = Earnings 2-23-10

How to play it with options: I looked at three different plays with Mar '10 expiration: Long $15 Calls, Unbalanced strangle (long $15 calls, long $16 puts), and Long $15/$20 call spread. See Risk Profiles Below (Also note that I adjusted volatility downward by 15% as IV is traded at a premium to HV):

Unbalanced strangle:

Long Calls:

Call spread:

So I will be looking to buy the 2/1 unbalanced strangle 3 times for a total of 6 $15 calls and 3 $16 puts. Based on the closing prices of Friday this will cost $4.80 per spread for a total debit of $1,440.

SPX

I actually have a trade idea inspired by the guys over at Onn.TV. I am looking to sell the Feb '10 1100/1110 call spread. SPX closed at 1075.51 on Friday. Based on closing prices from Friday I can collect about $1.60 for this trade. I chose 1100 as in the short term I think that this will act as resistance going into expiration on Friday. But I may adjust the trade by using the SPY to adjust my risk. This would mean selling the 110/111 call spread on the SPY, which on Friday would fetch $0.21.

These are the only trade ideas that I have right now for the names on my list. I am going to try and spend a little more time finding potential trade ideas for OPEX. But we will see.

Friday, February 12, 2010

Looking at Government backed REIT's

Anworth Mortgage Asset Corporation is a real estate investment trust. It invests primarily in United States agency mortgage-backed securities issued or guaranteed by United States government sponsored entities, such as Fannie Mae or Freddie Mac, or an agency of the United States government, such as Ginnie Mae, including mortgage pass-through certificates, collateralized mortgage obligations, and other real estate securities, on a leveraged basis. The company’s portfolio includes agency mortgage-backed securities comprising agency adjustable-rate mortgage-backed securities, agency hybrid adjustable-rate mortgage-backed securities, agency fixed-rate mortgage-backed securities, and agency floating-rate collateralized mortgage obligations. The company qualifies as a REIT for federal income tax purposes. It would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Anworth Mortgage Asset Corporation was founded in 1997 and is based in Santa Monica, California.

Below is weekly chart of ANH that goes already back to February of 2007.

ANH is currently trading at about $6.85 and has a dividend yield of 15.71%. That is a pretty hefty yield, and at this point you should probably be asking yourself why it is so high? But lets take a look at the dividend history and how this thing performed during the height of the financial crisis. They have paid a dividend consistently on a quaterly basis since June of 1998. Take a look at the dividend payment history chart that I created below:

So you can see from the above that the stock continued to pay a dividend throughout th financial crisis, but it dropped quite significantly. But it has been steadily increasing since about Jan of 2008. The question you have to be asking yourself is if the worst is over in the housing market? Or is there another shoe to drop? And if there is another shoe to drop, when do you think it is going to happen? I do think that the worst is over in the residential market, but of course I don't know for sure. But I like this name as I think that the government take a lot of the risk out of this stock and similiar names like it.

As mentioned in the company profile that I posted above. ANH utilizes leverage in order to magnify returns. But as you can see as the spread between what they borrow at and the return they recieve on the loans they are invested in can greatly effect the dividend on the common stock. Especially since the preffered shared holders get paid out first before common stock holders. So this is best seen towards the middle to end of 2005 as rates from their adjustable rate MBS reset vs their borrowing rate. If you want more certianty you can always purchase the prefered A or B shares, which get paid before any common shareholders. It also has a lot less volatility in the dividend that is paid out. Currently the Prefered A shares are paying a quaterly dividend of about $0.54 that has been constent since 2005 when they first sold these shares. But you are going to have to pony up more money for this increased safety vs the common stock.

For me I am more attracted to the common as the dividend yield is higher and the stock price is about a 4th the price of the prefered A shares. On top of that with the common you get to capture upside in the dividend in quaters or years that the company performs better. The downside is that when the company performs poorly your dividend will be adjusted to reflect that poor performance where the preffereds will still continue to recieve their dividend.

What about the P/E? ANH is currently trading with a p/e of 6.27. But more importantly is based on foward earnings of $1.19 it is trading at a p/e of 5.75.

When is the Common Stock dividend paid?Our Board of Directors meets to announce earnings and declare the dividend in April, July, October and December. The dividend is then paid in May (1st quarter payment), August (2nd quarter payment), November (3rd quarter payment) and January (4th quarter payment). As a REIT, we are required to pay out 90% of our earnings in the form of dividends in the year the earnings occur (the 4th quarter dividend is taxable in the year it is declared, even though it is paid in January of the following year). Therefore, our dividend payments will increase or decrease in relation to each quarter's earnings. To see a list of our historical dividends, please visit our Dividends page.

My Position:

The low over the past 6 months is $6.65 which was put in on 1/22/10. So I think that at current prices the the stock are attractive. So the question is how do I enter into the position. Instead of buying the stock outright today, I would rather use options by way of selling puts. I am looking to sell the Apr '10 $7.5 puts that are currently trading at $0.7 which would give me an average price of $6.80 if I were exercised. I chose Apr so that way if I am exercised I will receive the dividend. I do intend to get exercised but if I am not exercised I happily just keep the premium and look for my next play.

Thursday, February 11, 2010

Wednesday, February 10, 2010

Tuesday, February 9, 2010

The Value of being Wrong

When you lose money on a trade it messes with your head and self confidence. It is very easy to become very destructive to your account value, trying to make up those losses in an attempt at revenge. It is also very easy to become discouraged and leave the market all together. This is a normal weeding out process that the market performs on a daily basis. You have to look at it this way, everyday the market is recruiting the top athletes in trading. And if you are not willing to work at this, the coach is going to cut you faster than you can blink an eye.

With every loss comes a learning lesson. The question is will you pick up on the lesson and adjust your trading accordingly? Look at it this way, you already paid the tuition so you better get the most out of it.

My own learned lessons:

During the current shift in the markets direction I gave back some of my profits that I had made during the past few months. This is not what concerns me as I know that losses are a part of the game. It is how much I lost and why. Since November I was up about 27% in my account or about $4,500 (As of the middle of January). In my opinion I was trading very well until about mid-January. I started to get lazy in my trade selection and analysis. I also started to increase my size in strategy's I had very little experience trading. I let the Euphoria of wining drive my trading. When you are trading from cloud 9, you get a false sense of confidence. You are almost convinced that you have the Midas touch. This clouds your judgment. So with that said lets look at a few mistakes that I made and what I have learned and how I will incorporate it into my trading.

1) After experimenting with the Iron Condor I had some trades that worked out well. I took the performance of this small sample of trades and made a generalization and did not consider what could happen if the stock moved beyond what the option market was pricing in. This leads me to my trade in NFLX. Previously in my prior 3 trades I was only playing with 2-3 lots at a time. But due to my performance over the past few months and the success trading the prior Iron Condors I decided to bump my size up to 10 lots on NFLX. As I had mentioned when I modeled out this trade I did not account for movements outside of what the options market was pricing in so going into earnings I was expecting a loss at most of $200, even though the max risk was at $1250. Based on the inputs that I adjusted this was the worst case scenario for me, boy was I wrong. The market was pricing in about an 11% move and NFLX shot up like 25% after its earnings release. I was immediately close to my max loss. Now instead of booking the loss and moving on I decided that I could out smart the market and try to repair the position only to make the losses worse. After I closed out the entire position I ended up losing about $1,500 (or about 33% of my gains).

So what did I learn:

a) Until you have enough data and experience implementing a particular strategy, keep you size small.

b) If you are wrong, don't throw good money after bad. Just admit you were wrong take the loss and move on.

c) When you are doing really well you need to be extra cautious with your trade selection. Cloud 9 "clouds" your judgment. You are not invincible.

2) Making money from the short side. I knew the market was changing, which is why I moved to almost 90% cash on January 14th. I was too quick to jump right back into the market. With in a week I was back invested to about 75%. I commented on an earlier blog about this. I want to implement a rule in my trading that every time I move to 60% cash or more that I can't invest more than half with in a 2 week period. With the $1,500 loss in NFLX along with another $1,500 that I loss on various long positions that is about a $3,000 loss. So I basically wiped out all of January's gains. I think that this rule would had saved me at least half of those losses.

Lastly I made the mistake of closing out my last purchase of SPY puts at the $108 strike. I set a game plan as to where I would buy my first lot and second lot. The first price target was triggered and I bought 5 puts for $0.95 a piece. The second price target was never triggered and neither was my stop. But I closed them out again for a small profit. Holding them for another day or two would had been good for a double and triple, respectively. So I am working on a rule that will help me stay short. I am open to any suggestions that you may have.

Good Luck Trading!

Monday, February 8, 2010

Spreads vs. Longs/Shorts

Sunday, February 7, 2010

New Post Editor

http://www.google.com/support/blogger/bin/answer.py?answer=156829

Saturday, February 6, 2010

Now that the market is closed...

Both the entry and exit of these positions were out of pure panic. After I exited the call spreads I had to get up and go for a walk to clear my head. As each call spread was actually considered 2 positions, it caused me to trade 6 round trip day trades in a 5 day period which led to a margin call for pattern day trading. My first instinct was to fund my account with the additional money to bring me up to the minimum $25k so that I can trade immediately. But after I gathered my thoughts I figured it may be a good idea to just request a PDT reset that can be done once every 180 days. This means that I would not be able to trade for another 5 days until the day trades cleared but I think this would be good. I will have the next few days to reflect and analyze the market with out any pressure to put on new positions. I will also work on defining some risk metrics and finally write out my trading guidelines (For example, max risk per trade).

Things that I will try to internalize. The markets do not go strait up, but either does your account value. You will have periods of draw-downs and this is normal and a part of playing the game. When these draw-downs happen you job as a trader is to minimize losses in the best way you can. It is very easy to get scared away from the market and have self-doubt in periods of draw-downs. I had all kinds of negative thoughts as to why I would never be able to do this for a living and how I needed to change my trading style, but these are just irrational thoughts that happen when you are wrong. After I take a step back and clear my head, I don't believe any of those self-defeating thoughts but it is important to be able to identify these moments and work through them.

Have a great weekend!

Friday, February 5, 2010

Game plan execution...

The Game plan

ISRG --> Looking to sell the 340/350 Feb '10 for $1.35

GOOG --> Looking to sell the 550/560 Feb '10 for $1.50

PCLN --> Looking to sell the 220/230 Feb '10 for $1.75

I have finally been able to make the switch from bull mode to bear mode. I think that most of February will be down. I will start looking for longs sometime in February. I will be looking at the market leading stocks to regain their 50 day moving average as a sign that the market may be turning.

And as we get closer to Feb expiration I may look for put spreads to sell to turn these call spreads into iron Condors. I will update later as to what I actually put on and at what price.

The Breakdown, the writing on the wall changed...

Thursday, February 4, 2010

New S&P Chart--The Breakdown Edition

By: Scott RedlerThe market will always speak, and therefore, active traders must pay attention and listen. All the signs were there that this type of move was in the cards since the day companies started getting sold off heavily on great earnings reports and when key market stocks broke important moving averages. I am not going to rehash all the sings, as I posted them nearly every day on this blog. The biggest key was when the uptrend line was broken--that was a game changer!

On January 21, 2010 the S&P was sitting at 1,130. That was then, but this is now:

What kind of market are we in?

What Type of Market Are We In?

Feb 4th, 2010 | By sspencer | Category: General Comments, Steven Spencer (Steve's) Blogs, Trading TheoryWe are in a downtrending market! What? We are in a downtrending market!! What? downtrend!!!!!! What does this mean for short term traders?

- Short stocks if they pop to previous support levels

- If the market trends up for two days then pray for a third day gap up so you can short the market!!

- Trade with less size as downtrending markets tend to be more volatile

- Be mentally prepared for the market to meltdown at any time. See traderfeed.blogspot.com on an excellent post on what to look for. http://bit.ly/945ZkT

- If the market gaps down and there is a feeble attempt at a bounce on the Open then put your short caps on.

- Remember that stocks go down more quickly than they go up. Take a deep breath when your shorts start working and give them some room to trade lower

- If a stock makes a hard down move on volume wait for it to pop a little before initiating a short position

- Don’t fade down moves. Fade up moves!!

- Remember that in a weak market we don’t need to have a down day every single day. If we have two hard down days in a row be careful with your shorts on the third day. This isn’t September 2008. The market isn’t gonna drop 20% in a week

- It is OK to trade on the long side in a downtrending market. We certainly trade on the short side when the market is trending up. You just need to understand that the bigger chops are gonna be on the short side. i.e. AMZN 124.50 to 114, AAPL 202 to 190, GS 171 to 158. These moves all happened intraday. Correct. They weren’t swing trades. I guess you could call them intraday swing trades

Good luck with your trading tomorrow!

Are you ready?

Ready for the Big Game?

- Derek Hernquist

- February 4th, 2010

Most of us will watch the Super Bowl this weekend, and marvel at the offensive machines run by Manning and Brees. Are they that much more talented than the rest of the population? Compared to that stud on your high school or college team, then yes. Versus the other 30 NFL QBs(plus backups), I think the answer is a definitive NO. So why does it look so easy for them? What can we learn as market speculators?

I think much of the difference lies between their ears, in the way they process information. Take a supremely talented athlete and throw him into the neighborhood Turkey Bowl, and he will dictate the flow of the game. Put him with professionals, and he'd better get a plan real quick or he's Ryan Leaf. The preparation AND repetition needed at that level becomes just as important as arm strength and foot speed...replace strength and speed with instinct and intellect, and the conversation moves to trading.

If we think our opponents in this game are less talented than we are, our career won't last long. Sure, some have no business being in the arena and are punished quickly. But once markets have weeded out those that don't have "it", even the least skilled are pretty damn sharp. Who can't play devil's advocate on virtually any bullish or bearish argument advanced by a fellow pro? At that level, it's about preparation and repetition of edge. In the immortal words of Allen Iverson, we're talking about "Practice?!"

We can't control the flow of the market, nor can we ensure that our best plans will come to fruition. What we can do is have a few formations in place, and know what we're going to do when things line up a certain way. Seriously, do you think there's a defensive formation Peyton hasn't seen yet? A market formation Art Cashin hasn't seen yet? I don't know how many times Art hits his target, but Peyton hits 60% of the time, not 100%. He's made his mark by converting some of those 60% into huge plays by recognizing an imbalance, sending his guys to the weak spots, and throwing to that spot. Think that TD came from circling his team and drawing up a play in his palm?

As stated by Dr. Brett Steenbarger, success is something that is cultivated over time, with directed effort . We can do one of two things, be born to process information a little better than our opponents, or prepare like crazy in honing our processing skills. Probably a good idea to focus on the latter, rehearsing a variety of scenarios and developing our game plan ahead of time. In the end, it's still an art, but there's no reason not to hone our prep skills into a science and let our acquired instinct take over once the game begins.

Thursday, February 4, 2010

Learned something new today

I was analyzing my naked Mar $45 XLE Puts. While looking at the option chain I see that there is two ticker symbols for the $45 Mar strike price. I always assumed that they were separate because one was originally a LEAPS contract and one was the regular near-term expiration that doesn't become a ticker symbol until it's regular calendar cycle begins. So it turns out that this is correct, however, this is what I learned: the LEAPS contracts do not expire on the third Friday of that month, they expire on the last day or that month. So the LEAPS for the same month same strike price have slightly longer maturities and this is why the stay separate ticker symbols. I always wondered why your LEAPS didn't just turn in to the regular calendar cycle contracts once they became available. I thought maybe it was for capital gains reasons because LEAPS are taxed at the short-term rate even if you held it for more than a year.

Great timing

When you don't know what to do...

I really wished I would had kept the 108 puts that I sold yesterday as they would had been good for better than a double. But like I said I can't seem to hold the short side. Tomorrow the all anticipated jobs number comes out and because of the fragile market conditions a bad number could be just the catalyst for the next push lower. But then again a good number could be the catalyst to continue up. Or it could be a non-event. Damn, I wish I had a crystal ball.

I really do not know what to do. I am kind of getting some analysis paralysis. I am also trying to figure out the best time to lift my hedges on my longs. But not knowing or having a thesis of how far down this market could really go before it starts going up again scares me. I know on the charts the next important support level is in the 1030-1040 range, but I am not willing to make any bets on it. I like the idea of selling call spreads, but I should had done that on the bounce to collect the higher premium.

So with that said, I am going to take a step back and for now I am not going to add any new positions going into the jobs number tomorrow. I will wait and see what happens. I will sit on my hands so to speak. I will just try to work through some of my positions as we have 15 days left until Feb expiration and I have a few positions that will expire.

Wednesday, February 3, 2010

Earnings play in STLD

In recent weeks STLD made a run to a new 52 week high of over $20 per share. Since then it has had a 25% pull back. Analyst are forecasting $1.37 per share for earnings next year giving this one an attractive p/e of about 11.67. Now keep in mind that these estimates bet on the continuation of the recovery. I point this out as I am willing to take delivery of these shares at the $15 level.

Here is the daily chart:

Notice that I have also plotted the HV and IV on the lower studies of the chart. There is only a 3.8% difference betweeen HV and IV. Which to me kind of seems cheap considering the options market is pricing in a 10% move based on the front month ATM straddle which is trading for about $1.5. So I don't think I will have to worry about much of a volatility crush after the release of earnings.

Next we have the risk profile fof the trade: I bougth 5 Mar '10 16/15 synthetic's long (Buying the $16 calls and selling the 15 puts) for a net debit of $0.40 per synthetic.

Above I provided a bunch of price slices as to what this thing might do. Since I am not too concered with a volatility crush because one there is not that big of a difference.

Next I took the distribution of Open Interest for Feburary. Since about 1/19 Open interest has been increasing on both call side and puts side. But the ratio of calls to puts is 1.54:1. So options players are indicating a bullish bias into earnings. $17 looks to be the home of the highest open interest and my act as a gravitational pull if earnings are good.

Currently the stock is trading at $15.89 going into the close. The estimate that the street is looking for on EPS $0.17 on Rev's of $1.08 Billion.

SLV

Tuesday, February 2, 2010

Current positions and Summary updates

Below are my current holdings.

Short PCLN

I got in yesterday when PCLN was trading at about $199, it did rally but this is a high priced stock and very volatile so you can not panic with moves against you. As long as this stock stays below its 15 day moving average I am in. Currently that target is at $207 at which point I would have a loss of about $285. I am trying to slowly expose my portfolio to the downside.

You will see from below that I am down about $200 in the position as of now.