Sent to you by Dominic via Google Reader:

via T3Live Blog by Scott Redler on 6/16/10

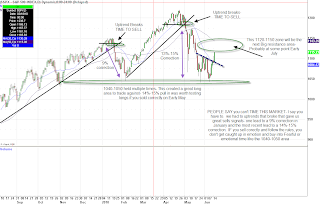

By: Scott RedlerIn January the Uptrend broke and it led to a 9% correction off the highs. In early May the next uptrend broke, which led to a larger 13%-15% correction. If you chased the market at the highs and "bought excitement" then you got hurt.

The February 5th reversal led to new highs and the same type of reversal pattern happened on June 6th. We don't know where this one will lead to but you don't have to. You measure it along the way. The big area to watch will be 1120-1150 to see if it creates a right shoulder of a head and shoulders pattern. My theory is that we are just in the eye of the storm.

Yesterday the market powered through resistance and now we are short-term overbought. Our go-to stocks all made the most impressive moves, with some laggards even playing some catch-up. Last Thursday into Friday was the time to enter longs, when we talked about the Tech sector getting ready to show some momentum. Yesterday was your day to lighten up as most on T.V got excited. Entries and exits are still the key to staying profitable in this market. As of yesterday we were over 75 handles off the recent low, which is a big move in a short amount of time.

With the down open and the overbought readings, we are looking at 1103 as first support today, then 1096. If this market is any good we should not break the 1085-1090 zone. Today I am providing a free example of my Morning Gameplan price point sheet that I create for our T3Live community each morning. I hope you enjoy it.

Things you can do from here:

- Subscribe to T3Live Blog using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

No comments:

Post a Comment