Sent to you by Dominic via Google Reader:

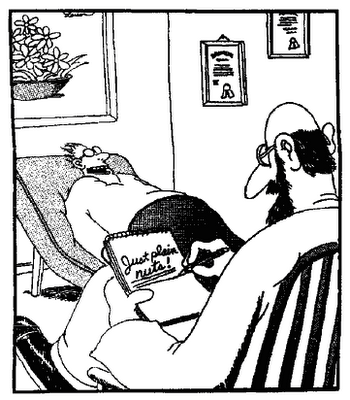

As a former therapist, one of the areas I would focus on with clients is the way in which they would perceive their situations. Using a technique called re-framing; I would help them see their "problems" from a different perspective. Often times, clients would be able to overcome roadblocks simply by combating their negative perception of situations. This was quick and a huge relief for my clients and similar techniques are used elsewhere.

In my wife's marketing career she would work on value re-framing with products for the company she worked for. In other words, she would bring about new value to an existing product simply by finding a new market or context for that product. Drug companies often use this same technique during clinical trials of drugs where the drug didn't do A, but it sure did do B. Rather than scrap the research done on the drug; they simply market it as a solution to B.

How can this be used in trading? After a trade is completed go back in and diagnose the trade. I suggest doing it several days after the trade is completed as this will help in bringing clarity as most emotions will be in check as time passes. Here are a few questions you can ask yourself as you diagnose your trades.

- Was it an income trade or a business expense?

- Did you practice proper risk management?

- Was the income/expense larger than you expected?

- What did you do right and what was done wrong?

- Was your stop too tight and the stock ended up going the way you thought?

- Did you exit too early and leave some money on the table?

- Was the target met?

- What would you have done differently?

- Used a wider stop

- Given a more aggressive target

- Checked sector/market performance

- What did you do that you would do again?

- Used proper risk management

- Used time (theta) to my advantage

Be honest with yourself and learn what you did wrong and, more importantly, what you did correctly. This process will allow you to discover new strengths and weaknesses that you might have. The idea is to focus on the positive and then negative. It's easy to focus on the negative so avoid doing that first but rather after you've built yourself up. Here's the key...Turn the items that you've deemed as negative into a positive light. It may be difficult at first, but worth it.

You might find that, over time, you are just no good when it comes to a certain stock or sector and thus you can avoid that stock/sector, etc. As an example, I found out that over a period of time that some of my biggest losing days were Fridays; regardless of the asset. As a result, I turned that into a positive by doing two things-not trading on Fridays and doing core research instead. Both of these activities increased my equity curve!

Things you can do from here:

- Subscribe to Psychtrader using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

No comments:

Post a Comment