Below is a summary of my trade activity for December:

A personal finance blog about trading, investing, and other wealth building strategies. Learn how to trade options, get trade ideas, and make money online from home.

OPTIONS FEES HAVE NOWHERE to go but up. U.S. options trades take place on seven major exchanges. Three of them -- The Chicago Board Options Exchange (CBOE.org, CBOE.com), International Securities Exchange (www.ise.com) and Boston Options Exchange (www.bostonoptions.com) -- have recently filed for fee increases that will kick in during 2010. These fee structures are quite complex, but will result in higher fees paid by brokerages to conduct trades.

Firms that have had relatively low fees for options trading will most likely have to raise their rates just to maintain some kind of profit margin. I imagine the firms that have charged higher commissions will just go ahead and absorb the increased exchange fees.

Wade Cooperman, CEO of tradeMonster (www.trademonster.com), says, "We are increasingly concerned the rising exchange fees will lead to retail investors seeing their cost of trading increase."

For now most of my trades are playing the greek Delta. As noted above I have slapped a $85 price target on this baby. So why is the Delta on this particular option. Well ITM options have a delta closer to 1 than OTM option. So with a Delta of $0.78 this means that every point move to the upside that XOM makes this option will move $0.78 or $78 in my favor. So a $10 move would put me in the money by $780, if, and I bold this because this is the big caveat, everything else meaning the other greeks remain constant. Which they all change over time, but this gives a ruff estimate.

What does the chart look like?

Notice the recent selloff. This presents good entry for new positions in my opinion. Looks like investers were able to support the price at about $68. Also notice that the 53 week low is around $62 and it hasn't traded much lower than $57 in the past two years. Like I have said before, not that the past is an indication of the future, but it is a base in which to start from.

Onn.tv XOM April '10 75/80 vertical spread

Here are the probabilities for XOM in this vertical spread idea. As I mentioned it is going to cost about $0.60 per spread for a potential reward of $4.40 per contract or 733%. But as you can see based on the probabilities there is a trade off for such a nice return. The likely hood that it reaches the $80 target is 15.94% . So from here you have to make your bets as what kinds of catalyst will get XOM to hit targets and how confident do you feel. But other than that it is a cheap bet so if you are wrong it is not that much money.

If you have any questions on how to interpret the probabilities, just ask me.

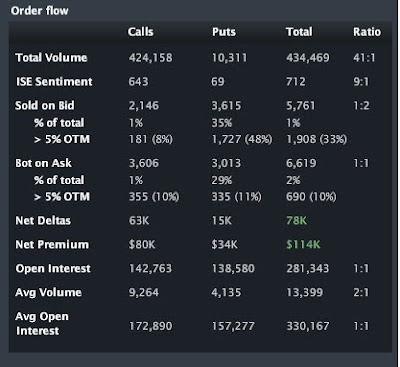

The first thing that stands out is the Jan '10 $45 strike which had volume of 221,069 call contracts on an open interest of 10,368. Unless there was some serious churning then these were most likely opening positions. This represents about 52% of the total volume just at this strike. There is some extreme bullishness. Lastly you can see that between the strike prices of $40-$55 is where 294,047 or 70% of the volume took place. So now that we now know where the action took place lets take a look at the 20 largest orders that hit the tape.

As you can see above there were some huge block trades that took place at the $45 strike. So how can we use this analysis as a trading idea? With this much call buying is there a floor put in at $45? Let me know what you guys think, I will follow up on this post tomorrow as I figure out how I can use this information to initiate a high probability play.

I would love to hear your insight...

What does the chart look like:

To be honest, I really did not look at the chart on this play.

As you can see in the above, my break-even price for RIMM is $49.55 which is a price I would not mind taking ownership off. At this price with estimates for the year at $4.15 this puts a p/e of about 11.9, and forward estimates are $4.80 which leaves this stock at a bargain with a p/e of 10.3.

I am looking for a quick trade on this play, but if I don't get it I have a back up plan of taking delivery of the stock and selling covered calls on it.

The chart:

As you can see on the chart, RIMM had a pretty sizable sell off that started on 9-24-09 which looks like it bottomed out on 11-2-2009. Since then it has been in a nice up move. Confirmation in the up move came when RIMM traded above its 50 day moving average. I would also like to see the 15 day MA cross over the 50 day to the upside soon.

![[Snapshot+Analysis.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgw5lRMwe-TPKgMzHzvUbuQ3oBslIzQe7eDX1aXDNd0gwcj2Uf4-7TKIGm-tgimFCOIeSqatVq4SlNTGyAt2fTfIuEMs0zNUT1cm0kpd6ZRK-V_Jx-0csDesDMkN3o_q9xGsdLY2pnKHNPq/s1600/Snapshot+Analysis.jpg)

Pay particular attention to the volume behind the upmove. It traded half of its average daily volume in about 30 minutes. Look for shorts to get trapped and forced to cover on the way up. We are still targeting a move up to about $20. Would be normal to see a pullback or a few consolidation days before it continues the move higher.

I was also looking at implied volatility and the greeks. Today IV has shot up about 10% which has caused my position to lose premium at a slower rate. But I am paying particular attention to the greek vega as this measures how much the contract will move with a point change in IV. Currently it is .05 meaning that every contract that I have will lose $5 of premium value for every 1 point drop in IV. On 5 contracts that gives the total position a Vega of $25 meaning that every point to the downside on IV makes the premium $25 less. This would put me in the money an additional $250 on top of the $600 I am already up on the position. I anticipate that volatility will come in when the stock is ready to rest. It is interesting nonetheless to see volatility rise as price goes up as usually there is an inverse relationship.

http://videos.worden.com/classes/AnaheimClassNotes_1109.pdf