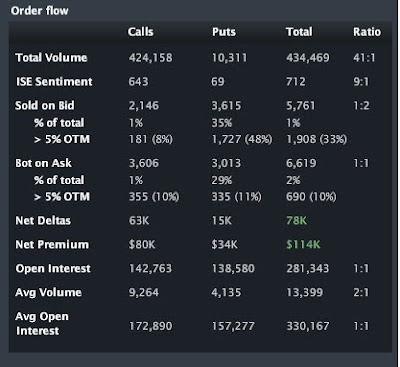

As you can see from the above screen shot PM traded 434,469 contracts vs a daily average of 13,399. This is represents a 3,242.57% increase over daily volume. Wow that is huge. I scanned the news and could not find any significant new as too why this abnormal volume has crossed the tape. The only thing that I found is that the dividend is paid tomorrow, which I believe it is already too late to get the dividend as the ex-dividend date has already passed. So then I decided to dig a little deeper and see what the order flow was like, See below:

As you can see from the above all but about 10,000 of the 424,158 contracts were puts, the rest were calls. You can also see that the Net premium is positive $114k, which means the majority of the volume represented buying vs selling. Or put another way people were getting long delta vs being short delta. Now I am asking myself: Where or at what strikes was this volume done? I already know that 97% of the volume was from calls vs 3% from puts. And I know that before toady's volume there was an open interest of 281,343 vs volume of 424,158. So lets take a look at where the volume took place and see if we can draw any conclusions:

The first thing that stands out is the Jan '10 $45 strike which had volume of 221,069 call contracts on an open interest of 10,368. Unless there was some serious churning then these were most likely opening positions. This represents about 52% of the total volume just at this strike. There is some extreme bullishness. Lastly you can see that between the strike prices of $40-$55 is where 294,047 or 70% of the volume took place. So now that we now know where the action took place lets take a look at the 20 largest orders that hit the tape.

As you can see above there were some huge block trades that took place at the $45 strike. So how can we use this analysis as a trading idea? With this much call buying is there a floor put in at $45? Let me know what you guys think, I will follow up on this post tomorrow as I figure out how I can use this information to initiate a high probability play.

I would love to hear your insight...

I just used Yahoo Finance to quickly see the current price of the stock because I wasn't sure what it was, and below is what I copied from their option chains.

ReplyDelete45.00 PFYAI.X 4.50 0.20 4.50 4.70 221,069 10,368

If volume was 221,069 and open interest is now 10,368 than I would assume that was a closing trade and somebody was exiting being long those calls. I don't know what to make of this volume action. I don't know that I'm experienced enough to draw any solid conclusions. That's an interesting tool though. I often hear the Najarian guys commenting on themes like this, they don't exactly know who the volume is from or what the intent is, but they often just follow along. I have a problem with this following the "smart money". There seems to be a flawed assumption out there that options traders are somehow smarter than the rest of us because options are difficult to understand, therefore if somebody is playing big with options they must know what they are doing.

The only conclusion I think I can come up with is the obvious, somebody is betting big, or getting out of a big bet. You have to assume it's not an inside information job because that is too much volume, that would be caught easily if something turns out to be going on. What are your initial thoughts?

So this morning I did abit more research because there had to be an explanation for all that call volume. I found out that 12/23 is the ex-dividend date and it is payable on 12/28. So all that volume was investors trying to capture that dividend.

ReplyDeleteI confirmed this with my contact from livevolpro.com who works at the ARCA exchange in San Francisco. He also noted that the $65 calls that I saw on the top 20 were a mistake and were corrected over night. I will foward the email.

But I do think that this kind of anlaysis will be beneficial in the future. Because if there is enough buying pressure at a strike like the kind we saw in PM that opportunities could arise. With that kind of volume I would think that the big institutions would put there money where there mouth is to support the price. They are the price makers and we are just the price takers.

So this time I do not think there is a trade but maybe next time.

I found an example of what most likely happened yestereday. See below:

ReplyDeleteDividend Capture using Covered Calls

Some stocks pay generous dividends every quarter. You qualify for the dividend if you are holding on the shares before the ex-dividend date.

Many people have tried to buy the the shares just before the ex-dividend date simply to collect the dividend payout only to find that the stock price drop by at least the amount of the dividend after the ex-dividend date, effectively nullifying the earnings from the dividend itself.

There is, however, a way to go about collecting the dividends using options. On the day before ex-dividend date, you can do a covered write by buying the dividend paying stock while simultaneously writing an equivalent number of deep in-the-money call options on it. The call strike price plus the premiums received should be equal or greater than the current stock price.

On ex-dividend date, assuming no assignment takes place, you will have qualified for the dividend. While the underlying stock price will have drop by the dividend amount, the written call options will also register the same drop since deep-in-the-money options have a delta of nearly 1. You can then sell the underlying stock, buy back the short calls at no loss and wait to collect the dividends.

The risk in using this strategy is that of an early assignment taking place before the ex-dividend date. If assigned, you will not be able to qualify for the dividends. Hence, you should ensure that the premiums received when selling the call options take into account all transaction costs that will be involved in case such an assignment do occur.

Example

In November, XYZ company has declared that it is paying cash dividends of $1.50 on 1st December. One day before the ex-dividend date, XYZ stock is trading at $50 while a DEC 40 call option is priced at $10.20. An options trader decides to play for dividends by purchasing 100 shares of XYZ stock for $5000 and simultaneously writing a DEC 40 covered call for $1020.

On ex-dividend date, the stock price of XYZ drops by $1.50 to $48.50. Similarly, the price of the written DEC 40 call option also dropped by the same amount to $8.70.

As he had already qualified for the dividend payout, the options trader decides to exit the position by selling the long stock and buying back the call options. Selling the stock for $4850 results in a $150 loss on the long stock position while buying back the call for $870 resulted in a gain of $150 on the short option position.

As you can see, the profit and loss of both position cancels out each other. All the profit attainable from this strategy comes from the dividend payout - which is $150.

So I have been trying out the livevolpro.com options analytics tool, and although there are some pretty cool tools. It is not worth $100 a month to me.

ReplyDeleteSo for now I will keep it in my bookmarks, and maybe someday down the line I may circle back to it.

I just thought I would give you guys an update.